Input Data

Belgian energy system data in 2035

Overview This appendix reports the input data for the application of the LP modeling framework to the case study of Belgium between 2015 and 2050. Data are detailed for the year 2035 and 2015, the latter used for model verification. Trends to extrapolated these data for the other years are given. This appendix is an improved version previously presented in 2,6

The data can be grouped into three parts: resources (Section Resources), demand (Section Demand) and technologies (Section Technologies.. For resources, the work of the JRC 37, Biomass atlas 38 and Hydrogen Import Coalition39 have been used to complement and confirm or correct the prices already reported in previous works 2,5,11. For energy demand, the annual demand is calculated from the work of the European Commission’s projections up to 2050 27. As a complement, the time series are all calculated on the basis of the year 2015. For technologies, they are characterised by the following characteristics: energy balances, cost (investment and maintenance), and environmental impact (global warming potential (GWP)). For weather dependent technologies (wind, solar, etc.), real production for the year 2015 was collected from the TSO.

For GWP and GHG emissions, LCA data are taken from the Ecoinvent database v3.2 [1] 40 using the “allocation at the point of substitution” method. GWP is assessed with the “GWP100a - IPCC2013” indicator. For technologies, the GWP impact accounts for the technology construction; for resources, it accounts for extraction, transportation and combustion. In addition, data for fuel combustion are taken from Quaschning41.

For the cost, the reported data are the nominal values for Belgium in the year 2035 All costs are expressed in real [2] Euros for the year 2015 (€2015). If not specified, € refers to €2015. All cost data used in the model originally expressed in other currencies or referring to another year are converted to €2015 to offer a coherent comparison. Most of the data come from a previous work 2,5, and were expressed in CHF2015 (Based on the average annual exchange rate value from ECB https://www.ecb.europa.eu, the annual rate was 1€2015 = 1.0679CHF2015). The method used for the year conversion is illustrated by Eq. (43).

Where \(C\) and \(y\) are the currency and the year in which the original cost data are expressed, respectively, USD is the symbol of American Dollars and the CEPCI 42 is an index taking into account the evolution of the equipment cost (values reported in Table 5). As an example, if the cost data are originally in EUR2010, they are first converted to USD2010, then brought to USD2015 taking into account the evolution of the equipment cost (by using the CEPCI), and finally converted to €2015. The intermediate conversion to USD is motivated by the fact that the CEPCI is expressed in nominal USD. Although this conversion method is originally defined for technology-related costs, in this paper as a simplification it used also for the cost of resources.

Year |

CEPCI |

|---|---|

1982 |

285.8 |

1990 |

357.6 |

1991 |

362.3 |

1992 |

367.0 |

1993 |

371.7 |

1994 |

376.4 |

1995 |

381.1 |

1996 |

381.7 |

1997 |

386.5 |

1998 |

389.5 |

1999 |

390.6 |

2000 |

394.1 |

2001 |

394.3 |

2002 |

395.6 |

2003 |

402.0 |

2004 |

444.2 |

2005 |

468.2 |

2006 |

499.6 |

2007 |

525.4 |

2008 |

575.4 |

2009 |

521.9 |

2010 |

550.8 |

2011 |

585.7 |

2012 |

584.6 |

2013 |

567.3 |

2014 |

576.1 |

2015 |

556.3 |

Resources

Resources can be regrouped in two categories: endogenous and exogenous. In the case of Belgium, endogenous resources are exclusively renewables. They account for solar, biomass, wind and hydro. The only endogenous resource which is non renewable is waste. In addition, energy can be imported from abroad (exogenous). These resources are characterised by an import price and a maximum potential. Exogenous resources account for the import of hydrocarbons, electricity or other fuels.

The availability of all resources, except for biomass, and non-RE waste, is set to a value high enough to allow unlimited use in the model. Table 8 details the prices of resources (\(c_{op}\)), the GHG emissions (\(gwp_{op}\)) associated to their production, transportation and combustion; and endogenous availability of resources. Export of electricity are possible, but they are associated to a zero selling price. Two kinds of emissions are proposed: one accounting for the impact associated to production, transport and combustion (based on GWP100a - IPCC2013 5); the other accounting only for combustion (based on Quaschning41). Total emissions are used to assess energy system emissions. Combustion only is used to calculate the direct CO2 emissions that can be captured and used through a carbon capture technology (latter presented).

Local renewable resources

The majors renewable potentials are: solar, biomass and wind. Additionnaly, Belgium has hydro and perhaps affordable geothermal. Wind, solar, hydro and geothermal are limited by the number of technologies deployable, while biomass is limited by the amount of resources available.

Wind, solar, hydro and geothermal

The energy transition relies on renewable energies, which makes their deployment potential a critical parameter. In 2015, 6% of the primary energy consumed in Belgium was renewable, mainly biomass, solar and wind. In the following, we summarise the potential for the different resources: in terms of available potential for biomass and waste (Table 6); or in terms of capacity for solar, wind, geothermal and hydro (Table 7). These data are put into perspective with the real data for 2015.

Technology |

2015 [aa] |

max. potential |

Units |

|---|---|---|---|

photovoltaic |

3.85 |

\(\approx\)60 [bb] |

[GW] |

onshore wind |

1.18 |

10 [cc] |

[GW] |

offshore wind |

0.69 |

3.5 |

[GW] |

hydro river |

0.11 [dd] |

0.120 |

[GW] |

geothermal |

0 |

\(\approx\)0 [ee] |

[GW] |

geothermal |

\(\approx\)0 |

\(\approx\)0 |

[GW] |

cen. solar th. |

0 |

\(\approx\) 70 |

[GW] |

dec. solar th. |

0 |

\(\approx\) 70 |

[GW] |

Due to land availability, the solar potentials are limited to around 1% of total Belgian lands (250km\(^2\)). This is equivalent to \(\approx\)60 GW of PV or \(\approx\)70 GW of solar thermal.

Resources |

2015 |

max. potential |

Units |

|---|---|---|---|

bioethanol |

0.48 [ff] |

0 |

[TWh] |

biodiesel |

2.89 |

0 |

[TWh] |

SNG |

0 |

0 |

[TWh] |

H2 |

0 |

0 |

[TWh] |

woody [gg] |

13.9 |

23.4 |

[TWh] |

wet |

11.6 [hh] |

38.9 |

[TWh] |

7.87 |

17.8 |

[TWh] |

Bioethanol also accounts for other bio-fuels except biodiesel. In 2015, 0.21 TWh of bioethanol have been imported, the rest of the biofuels have been produced locally from crops . In the model, the crops available to produce sustainable biomass are accounted for, and can produce wet or woody biomass.

Endogenous potential. See following section.

Belgium production of bioethanol, biomethanol, biogas and biodiesel is accounted for as wet biomass.

Wind, solar and biomass are foreseen to be the main resources. The land availability for PV is highly speculative, we propose a simple approach to estimate an order of magnitude of this limit. Assuming that it exists today 250 km\(^2\) of available well oriented roof [9] 46 and that the efficiency in 2035 will be 23% 35 with an average daily total irradiation - similar to historical values - of 2820 Wh/m\(^2\) in Belgium 36. The upper limit becomes 59.2 GW of installed capacity [10]. This limit is in line with a study performed by the Belgian TSO which proposes arbitrarily 40 GW 45. The hydro potential is very limited and almost fully exploited. Even if geothermal heat is used for heating through DHN since 1986 at Saint Ghislain 48, research about the geothermal potential in Belgium are at their early stages. In 2015, a new project started (the Balmatt project). Nowadays, the installation produces 1.5 MW of electricity (in 2019). The project is expected to scale up to 5 MW of electricity 47. However, there is no large facility yet and the potential is not accurately estimated. A study performed by the VITO evaluates the potential in Flanders to 3.1 GWe and they extend it to 4 GWe for the whole Belgian potential 46. However, because of a lack of reliable sources about geothermal potential, we consider the potential as null in the reference scenario.

The wind potential is estimated to 10 GW onshore and 3.5 GW offshore 44. At the time of collecting the data (2011-2020), several potentials can be collected through various sources. As an example, the study from Devogelaer et al.46 proposes to use 9 GW and 8 GW for onshore and offshore, respectively. As another example, Dupont et al.49 estimates the wind potential based on its energy return on invested energy, in other words, its profitability. This study concluded that Belgium has a potential between 7 660 and 24 500 MW for onshore and between 613 and 774 MW for offshore [11]. At the time of writing, the wind energy is in the spotlight with collapsing investment costs and a rising potential. Indeed, Europe has one of the best potential worldwide and has a leading wind power industry. As an illustration of recent improvements the following argument motivates the increase of the Belgian wind potential: taller and taller wind turbines enable the use of faster and more constant wind. As a consequence, the offshore potential might be underestimated. On the other hand, the onshore potential might be overestimated as developers see their project often blocked by citizens. In a nutshell, the wind potential allowed is relevant, but perhaps slightly underestimated. As motivated in the results, due to its limited potential, wind will remain a small contributor of the energy mix with a maximum of \(\approx\)10%.

Biomass and non-RE waste

In the literature, waste and biomass are often merged, as it is the case in the European commission report 27. In this thesis, a distinction is made between biomass and waste. Waste accounts for all the fossil waste, such as plastics, whereas biomass is organic and assumed renewable. Biomass is split into two categories: one that can be digested by bacteria (wet biomass), such as apple peel; and one that cannot (woody biomass), such as wood. Hence, the organic waste generated by the municipalities is accounted for in woody or wet biomass and not as fossil waste.

In the literature, biomass potential highly varies based on the assumptions made, such as the area available to produce biomass, or the definition of sustainable biomass. In an European study, Elbersen et al.38 drew the biomass atlas of EU countries for different scenarios in terms of prices and potentials. According to a conservative approach, the sustainable scenario estimations are selected. In their work, biomass is declined in a larger variety of form. To adapt these data to our work, these varieties are aggregated into three types: woody biomass, wet biomass and non-RE waste. Waste accounts for common sludges, MSW landfill, MSW not landfill (composting, recycling) and paper cardboard. The overall potential is estimated to 17.8 TWh/y with an approximate price of 10.0 €/MWh. The price is estimated as a weighted sum between the different variety and their specific price (given in the document). Wet biomass accounts for all the digestible biomass, which are verge gras, perennials (grassy), prunings, total manure, grass cuttings abandoned grassland, animal waste and forrage maize (biogas). The overall potential is estimated to 38.9 TWh/y with an approximate price of 2.5 €/MWh. Woody biomass accounts for all the non-digestible biomass, which are roundwood (including additional harvestable roundwood), black liquor, landscape care wood, other industrial wood residues, perennials (woody), post consumer wood, saw-dust, sawmill by-products (excluding sawdust) and primary forestry residues. The overall potential is estimated to 23.4 TWh/y with an approximate price of 14.3 €/MWh.

Oleaginous (0.395 TWh/y) and sugary (0 TWh/y) potentials are two order of magnitude below the previous categories and thus neglected.

However, these costs do not account for treatment and transportation. Based on a local expert (from Coopeos), a MWh of wood ready to use for small wood boilers is negotiated around 28 €/MWh today, twice much than estimated prices. This order of magnitude is in line with the Joint Research Center price estimation in 2030 37. Thus, the price proposed in 38 are doubled. It results in prices for woody biomass, wet biomass and waste of 28.5, 5.0 and 20.0 €/MWh in 2015, respectively. The price for biomass is expected to increase by 27.7% up to 2050 37. By adapting these value to 2035, the prices are for 32.8 €/MWh woody biomass, 5.8 €/MWh for wet biomass and for 23.1 €/MWh for waste.

Imported resources

Dominating fossil fuels are implemented in the model and detailed in Section [ssec:case_study_imported_res]. They can be regrouped in hydrocabons (gasoline, diesel, LFO and NG), coal and uranium. Data is summarised in Table 8 and are compared to other sources, such as estimations from the JRC of prices for oil, gas and coal 37. They base their work on a communication of the European Commission 50.

There are a long list of candidate to become renewable fuels. Historically, biomass has been converted into bio-fuels. Two types of these fuels are accounted: bio-diesel and bio-ethanol. They can substitute diesel and gasoline, respectively. More recently, a new type of renewable fuel is proposed and can be labeled electro-fuels. Indeed, these fuels are produced from electricity. We consider that the energy content of these fuels is renewable (i.e. from renewable electricity). Four type of fuels were considered: hydrogen, ammonia, methanol and methane. To avoid ambiguity between renewable fuels and their fossil equivalent, it is specified if the imported resources is renewable or fossil.

Caution

to be updated + explain where data comes from.

The only difference being Thus, we have gas and gas_re, or h2 and h2_re. Gas refers to what is usually called ‘natural gas’, while gas_re refers to methane from biogas, methanation of renewable hydrogen,… Since, a specific study for the Belgian case has been conducted by a consortium of industries, Hydrogen Import Coalition39, which estimate new prices for the imports. Table 8 summarises all the input data for the resources.

Resources |

\(c_ {op}\) |

\(gwp_ {op}\) |

\({CO}_ {2direct}\) [26] |

avail |

[€2015/MWhfuel] |

[kgCO2-eq. /MWhfuel] |

[kgCO:sub:2/MWhfuel] |

[GWh] |

|

Electricity Import |

84.3 [27] |

206.4 [28] |

0 |

27.5 |

Gasoline |

82.4 [29] |

345 [28] |

250 |

infinity |

Diesel |

79.7 [30] |

315 [28] |

270 |

infinity |

LFO |

60.1 [31] |

311.5 [28] |

260 |

infinity |

Fossil Gas |

44.3 [32] |

267 [28] |

200 |

infinity |

Woody biomass |

32.8 |

11.8 [28] |

390 |

23.4 |

Wet-biomass |

5.8 |

11.8 [28] |

390 |

38.9 |

non-RE waste |

23.1 |

150 [28] |

260 [33] |

17.8 |

Coal |

17.6 |

401 40 |

360 |

33.3 [37] |

Uranium |

3.9 [34] |

3.9 40 |

0 |

infinity |

Bio-diesel |

120.0 |

0 [36]_ |

270 |

infinity |

Bio-gasoline |

111.3 [35] |

0 [36]_ |

250 |

infinity |

Renew. gas |

118.3 |

0 [36]_ |

200 |

infinity |

Fossil H2 [25] |

87.5 |

364 |

0 |

infinity |

Renew. H2 |

119.4 |

0 [36]_ |

0 |

infinity |

Fossil Ammonia [25] |

76 |

285 |

0 |

infinity |

Renew. Ammonia |

81.8 |

0 [36]_ |

0 |

infinity |

Fossil Methanol [25] |

82.0 |

350 |

246 |

infinity |

Renew. Methanol |

111.3 |

0 [36]_ |

246 |

infinity |

Energy demand and political framework

The EUD for heating, electricity and mobility in 2035 is calculated from the forecast done by the EUC in 2035 for Belgium (see Appendix 2 in 27). However, in 27, the FEC is given for heating and electricity. The difference between FEC and EUD is detailed in Section [ssec:conceptual_modelling_framework] and can be summarised as follows: the FEC is the amount of input energy needed to satisfy the EUD in energy services. Except for HP, the FEC is greater than EUD. We applied a conservative approach by assuming that the EUD equal to the FEC for electricity and heating demand.

Electricity

The values in table 1.3 list the electricity demand that is not related to heating for the three sectors in 2035. The overall electricity EUD is given in 27. However, only the FEC is given by sectors. In order to compute the share of electricity by sector, we assume that the electricity to heat ratio for the residential and services remain constant between 2015 and 2035. This ratio can be calculated from European Commission - Eurostat.59, these ratio of electricity consumed are 24.9% and 58.2% for residential and services, respectively. As a consequence, the industrial electricity demand is equal to the difference between the overall electricity demand and the two other sectors.

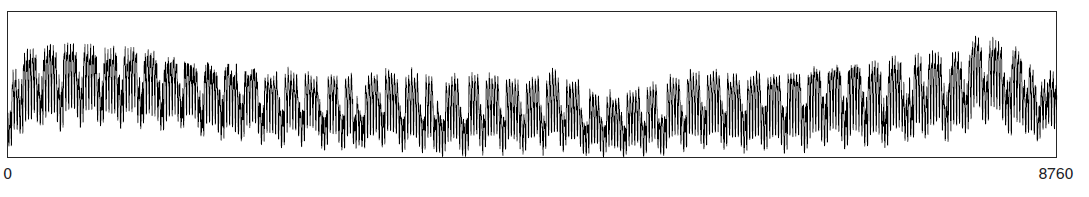

A part of the electricity is assumed to be a fixed demand, such as fridges in households and services, or industrial processes. The other part is varying, such as the lighting demand. The ratio between varying electricity and fixed demand are calculated in order to fit the real curve in 2015 (data provided by ENTSO-E https://www.entsoe.eu/). It results in a share of 32.5% of varying electricity demand and 67.5% of baseload electricity demand. demand of electricity is shared over the year according to %elec, which is represented in Figure 15. We use the real 2015 Belgian electricity demand (data provided by ENTSO-E https://www.entsoe.eu/). %elec time series is the normalised value of the difference between the real time series and its minimum value.

Varying |

Constant |

|

[TWh] |

[TWh] |

|

Households |

7.7 |

14.3 |

Industry |

11.1 |

33.7 |

Services |

11.0 |

14.1 |

Fig. 15 Normalised electricity time series over the year.

Heating

We applied the same methodology as in previous paragraph to compute the residential, service heat yearly demand. The industrial heat processes demand is assumed to be the overall industrial energy demand where electricity and non energy use have been removed. Yearly EUD per sector is reported in table 1.4.

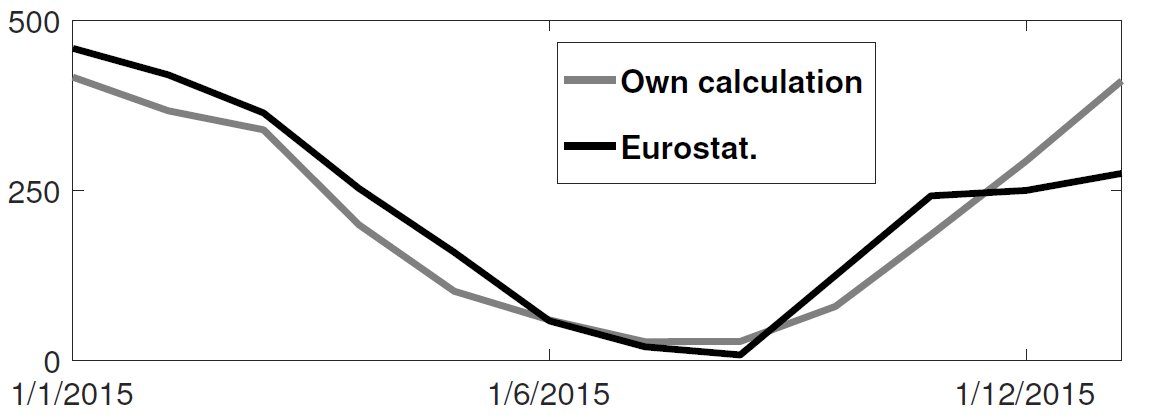

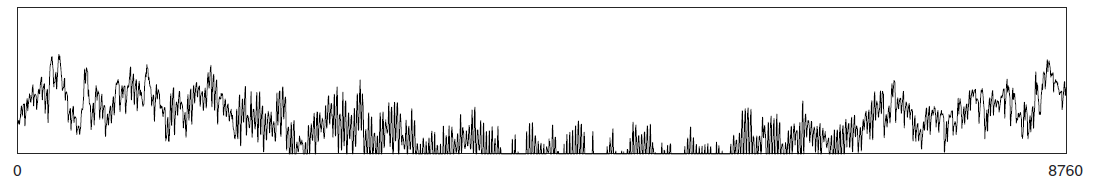

A part of the heat is assumed to be a fixed demand, such as hot water in households and services, or industrial processes. The other part represents the space heating demand and is varying. Similarly to the electricity, the ratio between varying electricity and fixed demand are the one of Switzerland, presented in 2,5 which are based on 52. The varying demand of heat is shared over the year according to \(%_{sh}\). This time series is based on our own calculation. The methodology is the following: based on the temperature time series of Uccle 2015 (data from IRM 60); the HDH are calculated; and then the time series. The HDH is a similar approach than the more commonly used HDD. According to Wikipedia, HDD is defined as follows: “HDD is a measurement designed to quantify the demand for energy needed to heat a building. HDD is derived from measurements of outside air temperature. The heating requirements for a given building at a specific location are considered to be directly proportional to the number of HDD at that location. […] Heating degree days are defined relative to a base temperature”. According to the European Environment Agency [37], the base temperature is 15.5\(^o\)C, we took 16\(^o\)C. HDH are computed as the difference between ambient temperature and the reference temperature at each hour of the year. If the ambient temperature is above the reference temperature, no heating is needed. Figure 16 compares the result of our methodology with real value collected by Eurostat [38]. The annual HDD was 2633, where we find 2507.

By normalising the HDH, we find \(%_{sh}\), which is represented in

Fig. 16 Comparison of HDD between Eurostat and our own calculation.

Fig. 17 Normalised space heating time series over the year.

Space heating |

Hot water |

Process heat [39] |

|

[TWh] |

[TWh] |

[TWh] |

|

Households |

70.2 |

18.0 |

0 |

Industry |

13.1 |

3.4 |

50.4 |

Services |

34.8 |

7.8 |

0 |

We define process heat as the high temperature heat required in the industrial processes. This heat cannot be supplied by technologies such as heat pumps or thermal solar.

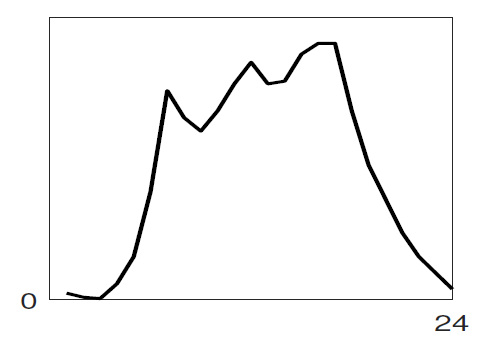

Mobility

The annual passenger transport demand in Belgium for 2035 is expected to be 194 billions 27. Passenger transport demand is divided between public and private transport. The lower (\(%_{public,min}\)) and upper bounds (\(%_{public,max}\)) for the use of public transport are 19.9% [40] and 50% of the annual passenger transport demand, respectively. The passenger mobility demand is shared over the day according to \(%_{pass}\). We assume a constant passenger mobility demand for every day of the year. This latter is represented in Figure Figure 18 (data from Figure 12 of 61). The annual freight transport demand in Belgium for 2035 is expected to be 98e09 tons kilometers 27. The freight can be supplied by trucks, trains or boats. The lower (\(%_{fr,rail,min}\)) and upper bounds (\(%_{fr,rail,max}\)) for the use of freight trains are 10.9% and 25% of the annual freight transport demand, respectively. The lower (\(%_{fr,boat,min}\)) and upper bounds (\(%_{fr,boat,max}\)) for the use of freight inland boats are 15.6% and 30% of the annual freight transport demand, respectively. The lower (\(%_{fr,trucks,min}\)) and upper bounds (\(%_{fr,trucks,max}\)) for the use of freight trucks are 0% and 100% of the annual freight transport demand, respectively. The bounds and technologies information are latter summarised in Table 1.15.

Fig. 18 Normalised passenger mobility time series over a day. We assume a similar passenger mobility demand over the days of the year.

Discount rate and interest rate

To compute their profitability, companies apply a discount rate to the investment they make. A discount rate is used for both cost of finance and for risk perception and opportunity cost. The cost of finance is to be compared with concepts like ‘hurdle rate’ or ‘rate of return’ usually calculated in accordance to an annual return on investment. Each individual investment physically occurring in year k, results in a stream of payments towards the amortization of this investment spread over several years in the future. The higher the cost of finance (or hurdle rate), the higher the annual payments spread over the lifetime of an investment and thus the higher the total cost. The hurdle rate affects only the investment costs so the impact is bigger for capital intensive technologies. We consider differentiated hurdle discount rates for different groups of energy supply and demand technologies, representing the different risk perception of industry versus individuals.

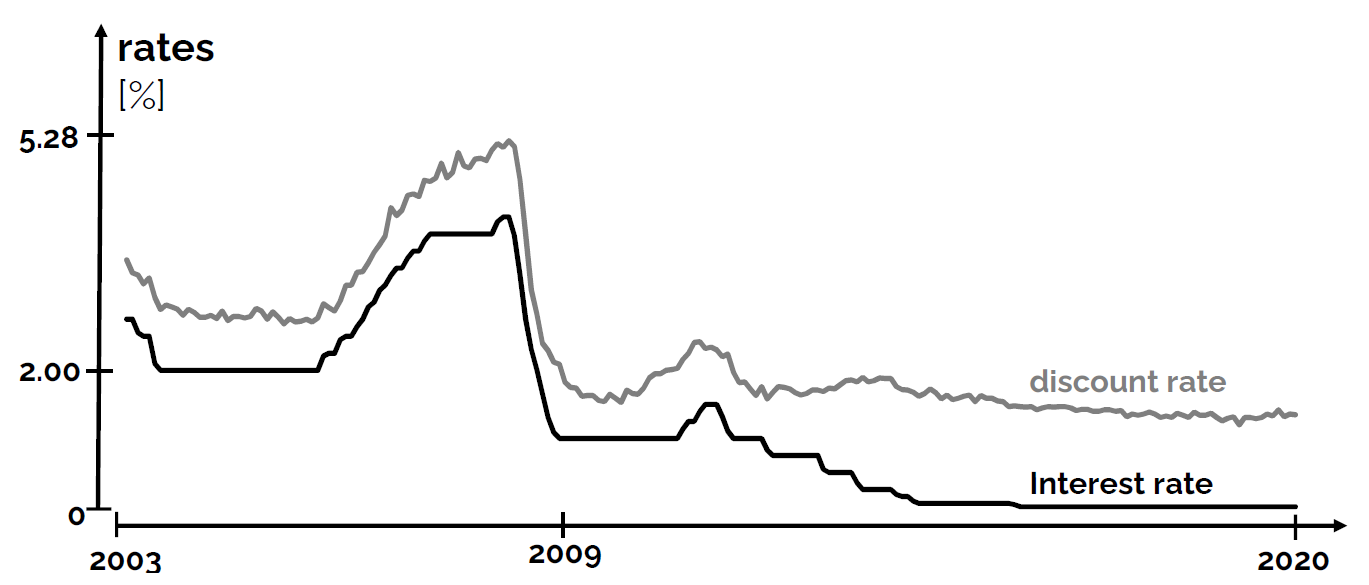

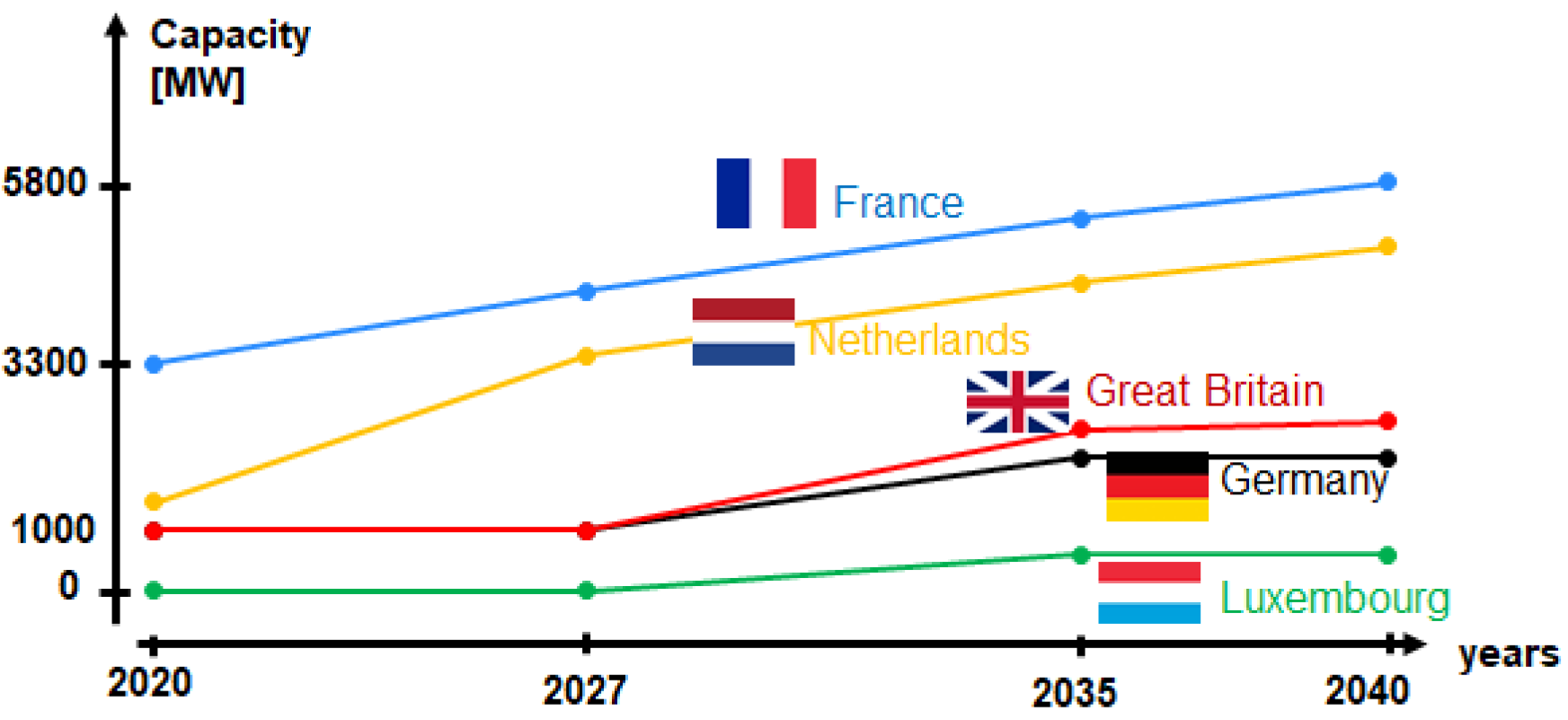

According with Meinke-Hubeny et al.62 who based their work on the JRC EU TIMES model 37 in line with the PRIMES model 27, the discount rate is around 7.5 up to 12% depending on the technologies. Discount rate cannot be directly converted into interest rate as the first is fixed by the market and the second is fixed by the central banks. As the evidence presented in Figure Figure 19 indicates, while these two interest rates tend to move together, they also may follow different paths from time to time.

Fig. 19 Comparison of Belgian interest rate and discount rate. The following rate was chosen to represent the discount rate: floating loans rate over a 1M€ (other than bank overdraft) and up to 1 year initial rate fixation.

For the different studies, the real discount rate for the public investor \(i_{rate}\) is fixed to 1.5%, which is similar to the floating loan rate over a million euros (other than bank overdraft) and greater than the central bank interest rate.

Technologies

The technologies are regrouped by their main output types.

Electricity production

The following technologies are regrouped into two categories depending on the resources used: renewable or not.

Renewables

\(c_ {inv}\) |

\(c_ {maint}\) |

\(gwp_ {constr}\) |

\(li fetime\) |

\(c_ {p}\) |

\(f_ {min}\) |

\(f_ {max}\) |

|

[€ 2015 /kW e] |

[€ 2015 /kW e/y] |

[kgCO 2-eq. /kW e] |

[y] |

[%] |

[GW] |

[GW] |

|

Solar PV |

870 [57] |

18.8 [57] |

2081 40 |

11.9 [58] |

0 |

59.2 [59] |

|

On. Wind Turbine |

1040 [60] |

12.1 [60] |

622.9 40 |

24.3 [58] |

0 |

10 [61] |

|

Off. Wind Turbine |

4975 [60] |

34.6 [60] |

622.9 40 |

41.2 [58] |

0 |

6 [61] |

|

Hydro River |

5045 65 |

50.44 65 |

1263 40 |

40 65 |

48.4 |

0.38 66 |

0.38 66 |

Geothermal [63] |

7488 [63] |

142 [63] |

24.9 40 |

30 |

86 67 |

0 |

0 [64] |

Investment cost based on 35. OM cost scaled proportionally based on IEA data.

Based on the real data of 2015 (data provided by ELIA, the Belgian TSO, which monitored 2952MW of PV, onshore and offshore in 2015 (Source: url{https://www.elia.be/}, consulted the 06/12/2019.})).

Assuming that 250 km\(^2\) of available roof well oriented exist today 46 and that the efficiency in 2035 will be 23% 35 with an average irradiation - similar to historical values - of 2820 Wh/m\(^2\) in Belgium, 36. The upper limit becomes 59.2 GW of installed capacity.

Onshore and offshore wind turbines in 2030 35. For Offshore, a correction factor of 2.58 is applied to have an LCOE of 79€/MWh in 2020, in line with recently published offer: https://www.enerdata.net/publications/daily-energy-news/belgium-agrees-79mwh-lcoe-three-offshore-wind-parks.html, visited on the 12-06-2020.

From previous study 44 with a correction on Offshore wind. The government announced a plan to build 6 GW of offshore wind, see Belgian offshore plateform.

A prototype (Balmatt project) started in 2019 and produces 4-5 MW 47. However, the potential is not accurately known.

ORC cycle at 6 km depth for electricity production. Based on Table 17 of 68. We took the reference case in 2030.

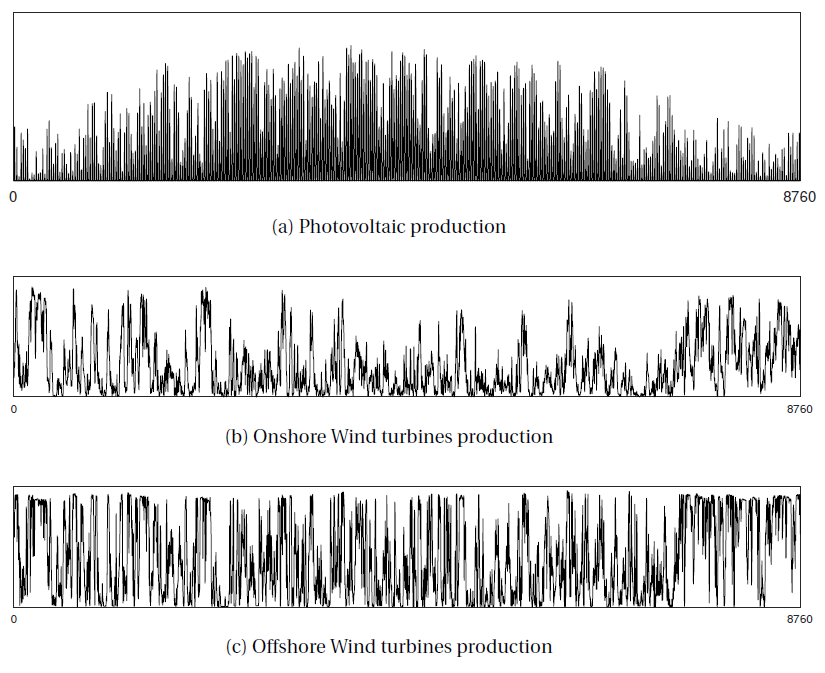

Data for the considered renewable electricity production technologies are listed in Table 11, including the yearly capacity factor (\(c_p\)). As described in the Section [ssec:lp_formulation], for seasonal renewables the capacity factor \(c_{p,t}\) is defined for each time period. These capacity factors are represented in Figure Figure 20. For these technologies, \(c_p\) is the average of \(c_{p,t}\). For all the other electricity supply technologies (renewable and non-renewable), \(c_{p,t}\) is equal to the default value of 1. As the power delivered by the hydro river is almost negligible, we take the time series of hydro river from Switzerland 2.

Fig. 20 Capacity factor for the different renewable energy sources over the year.

Non-renewable

Data for the considered fossil electricity production technologies are listed in Table 12. The maximum installed capacity (\(f_{max}\)) is set to a value high enough (100 000 TWe) for each technology to potentially cover the entire demand.

\(c_ {inv}\) |

\(c_ {maint}\) |

\(gwp_ {constr}\) |

\(li fetime\) |

\(c_ {p}\) |

\(\eta _e\) |

\(C O_{2, direct}\) [81] |

|

[€ 2015 /kW e] |

[€ 2015 /kW e/y] |

[kgCO 2-eq. /kW e] |

[y] |

[%] |

[%] |

[tCO2/ MWh e ] [81] |

|

Nuclear |

4846 [82] |

103 69 |

707.9 40 |

60 70 |

84.9 [83] |

37 |

0 |

CCGT |

772 69 |

20 69 |

183.8 40 |

25 71 |

85.0 |

63 [84] |

0.317 |

CCGTAMMONIA [89] |

772 |

20 |

183.8 40 |

25 |

85.0 |

50 |

0 |

Coal |

2517 [85] |

30 [85] |

331.6 40 |

35 71 |

86.8 71 |

49 [86] |

0.735 |

IGCC |

3246 [87] |

49 [87] |

331.6 40 |

35 71 |

85.6 71 |

54 [88] |

0.667 |

Direct emissions due to combustion. Expressed in ton CO2 per MWh of electricity produced. Emissions computed based on resource used and specific emissions given in Table 8.

Investment cost: 3431 €2015/kW\(_{\text{e}}\) 69 + dismantling cost in Switzerland: 1415 €2015/kW\(_{\text{e}}\) 72.

Data for the year 2012 73

0.4-0.5 GW\(_{e}\) CCGT in 2035 (realistic optimistic scenario) 71.

1.3 GW\(_{e}\) advanced pulverized coal power plant 74. cmaint is fixed cost (29.2 €2015/kWe/y) + variable cost (0.51 €2015/kWe/y assuming 7600 h/y).

Pulverized coal in 2025 (realistic optimistic scenario) 71.

1.2 GW\(_{\text{e}}\) IGCC power plant 74. cmaint is fixed cost (48.1 €2015/kWe/y) + variable cost (0.82 €2015/kWe/y assuming 7500 h/y).

IGCC in 2025 (realistic optimistic scenario) 71.

Use of Ammonia in CCGT is at its early stage. Mitsubishi is developping a 40 MW turbine and promises similar efficiency as gas CCGT 75. However, the high emissions of NOx requires a removal equipment which will reduce the power plant efficiency. As gas and ammonia CCGT will be similar, we expect a similar cost and lifetime. The only exception is the efficiency, which is assumed at 50% instead of 63% for a gas CCGT 76.

Heating and cogeneration

Tables 13, 14 and 15 detail the data for the considered industrial, centralized and decentralised CHP technologies, respectively. In some cases, it is assumed that industrial (Table 13) and centralized (:numref:` Table %s <tbl:dhn_cogen_boiler>`) technologies are the same. \(f_{min}\) and \(f_{max}\) for heating and CHP technologies are 0 and 100 TWth, respectively. The latter value is high enough for each technology to supply the entire heat demand in its layer. the maximum (\(f_{max,\%}\)) and minimum (\(f_{min,\%}\)) shares are imposed to 0 and 100% respectively, i.e. they are not constraining the model.

\(c_ {inv}\) |

\(c_ {maint}\) |

\(gwp_ {constr}\) |

\(li fetime\) |

\(c_ {p}\) |

\(\eta _e\) |

\(\eta _{th}\) |

\(C O_{2, direct}\) |

|

[€ 2015 /kW th] |

[€ 2015 /kW th/y] |

[kgCO 2-eq. /kW th] |

[y] |

[%] |

[%] |

[%] |

[tCO2/ MWh th ] [115] |

|

CHP NG |

1408 [116] |

92.6 [117] |

1024 40 |

20 71 |

85 |

44 [118] |

46 [118] |

0.435 |

CHP Wood [119] |

1080 69 |

40.5 69 |

165.3 40 |

25 77 |

85 |

18 69 |

53 69 |

0.735 |

CHP Waste |

2928 [120] |

111.3 [120] |

647.8 [121] |

25 77 |

85 |

20 77 |

45 77 |

0.578 |

Boiler NG |

58.9 5 |

1.2 5 |

12.3 [122] |

17 78 |

95 |

0 |

92.7 5 |

0.216 |

Boiler Wood |

115 5 |

2.3 5 |

28.9 40 |

17 78 |

90 |

0 |

86.4 5 |

0.451 |

Boiler Oil |

54.9 [123] |

1.2 [124] |

12.3 40 |

17 78 |

95 |

0 |

87.3 5 |

0.309 |

Boiler Coal |

115 [125] |

2.3 [125] |

48.2 40 |

17 78 |

90 |

0 |

82 |

0.439 |

Boiler Waste |

115 [125] |

2.3 [125] |

28.9 [126] |

17 78 |

90 |

0 |

82 |

0.317 |

Direct Elec. |

332 [127] |

1.5 [127] |

1.47 40 |

15 |

95 |

0 |

100 |

0 |

Direct emissions due to combustion. Expressed in ton CO2 per MWh of heat produced. Emissions computed based on resource used and specific emissions given in Table 8.

Calculated as the average of investment costs for 50 kWe and 100 kWe internal combustion engine cogeneration systems 52.

Calculated as the average of investment costs for 50 kWe and 100 kWe internal combustion engine cogeneration systems 79.

200 kWe internal combustion engine cogeneration NG system, very optimistic scenario in 2035 71.

Biomass cogeneration plant (medium size) in 2030-2035.

Biomass-waste-incineration CHP, 450 scenario in 2035 69.

Impact of MSW incinerator in 5, using efficiencies reported in the table.

Assuming same impact as industrial oil boiler.

925 kWth oil boiler (GTU 530) 80

Assumed to be equivalent to a NG boiler.

Assumed to be equivalent to a wood boiler.

Assuming same impact as industrial wood boiler.

Commercial/public small direct electric heating 81.

\(c_ {inv}\) |

\(c_ {maint}\) |

\(gwp_ {constr}\) |

\(li fetime\) |

\(c_ {p}\) |

\(\eta _e\) |

\(\eta _{th}\) |

\(C O_{2, direct}\) |

|

[€ 2015 /kW th] |

[€ 2015 /kW th /y] |

[kgCO 2 -eq./kW th] |

[y] |

[%] |

[%] |

[%] |

[tCO2/ MWh th ] [154] |

|

HP |

345 [155] |

12.0 [156] |

174.8 40 |

25 |

95 |

0 |

400 |

0 |

CHP NG |

1254 [157] |

37.5 [157] |

490.9 [158] |

25 71 |

85 |

50 [159] |

40 [159] |

0.500 |

CHP Wood [160] |

1081 69 |

40.5 |

165.3 |

25 77 |

85 |

18 69 |

53 69 |

0.736 |

CHP Waste [160] |

2928 |

111 |

647.8 |

25 77 |

85 |

20 77 |

45 77 |

0.578 |

CHP bio. dig. |

1374 [161] |

147.9 [161] |

647.8 [162] |

25 |

85 [161] |

13 [161] |

16 [161] |

2.488 |

CHP bio. hydro. |

4537 [163] |

227 |

647.8 [162] |

15 |

85 |

25.4 |

33.5 |

1.164 |

Boiler NG |

58.9 5 |

1.2 |

12.3 |

17 78 |

95 |

0 |

92.7 5 |

0.216 |

Boiler Wood |

115 5 |

2.3 5 |

28.9 |

17 78 |

90 |

0 |

86.4 5 |

0.451 |

Boiler Oil |

54.9 |

1.2 |

12.3 |

17 78 |

95 |

0 |

87.3 5 |

0.309 |

Geo thermal [165] |

1500 [165] |

57.0 [165] |

808.8 40 |

30 [165] |

85 |

0 |

100 |

0 |

Solar thermal [166] |

362 [166] |

0.43 [166] |

221.8 40 |

30 [166] |

10 |

0 |

100 |

0 |

Direct emissions due to combustion. Expressed in ton CO2 per MWh of heat produced. Emissions computed based on resource used and specific emissions given in :numref:` Table %s <tbl:prices_resources>`.

Calculated with the equation: cinv [EUR2011] = \(3737.6 * E^{0.9}\), where \(E\) is the electric power (kWe) of the compressor, assumed to be 2150 kWe. Equation from 82, taking only the cost of the technology (without installation factor).

Ground-water heat pump with 25 years lifetime 83.

CCGT with cogeneration 69.

Impact of NG CHP in from 5, using efficiencies reported in the table.

\(\eta\)e and \(\eta\)th at thermal peak load of a 200-250 MWe CCGT plant, realistic optimistic scenario in 2035 71.

Assumed same technology as for industrial heat and CHP (Table 13)

Cost estimations from 84 and efficiencies from 85. Data in line with IEA: 86

Construction emissions is assimilated to an industrial CHP waste technology.

Own calculation

Geothermal heat-only plant with steam driven absorption heat pump 70/17\(^o\)C at 2.3 km depth (from 35).

Total system excluding thermal storage (from 35).

\(c_ {inv}\) |

\(c_ {maint}\) |

\(gwp_ {constr}\) |

\(li fetime\) |

\(c_ {p}\) |

\(\eta _e\) |

\(\eta _{th}\) |

|

[€ 2015 /kW e] |

[€ 2015 /kW e/y] |

[kgCO 2 -eq./kW e] |

[y] |

[%] |

[%] |

[%] |

|

HP |

21 [209] |

164.9 40 |

18 [209] |

100 |

0 |

300 |

|

Thermal HP |

9.5 [211] |

381.9 40 |

20 |

100 |

0 |

150 |

|

CHP NG [212] |

1408 |

92.6 |

1024 |

20 71 |

100 |

44 |

46 |

CHP Oil |

1 306 [213] |

82.0 [213] |

1 024 [214] |

20 |

100 |

39 [215] |

43 [215] |

FC NG |

7 242 [216] |

144.8 [217] |

2193 40 |

20 87 |

100 |

58 [218] |

22 [218] |

FC H2 [219] |

7242 |

144.8 |

2193 |

20 87 |

100 |

58 |

22 |

Boiler NG |

159 5 |

5.08 5 |

4.8 5 |

17 78 |

100 |

0 |

90 5 |

Boiler Wood |

462 88 |

16 88 |

2 1.1 [220] |

17 78 |

100 |

0 |

85 88 |

Boiler Oil |

142 80 |

8.5 [221] |

21.15 |

17 78 |

100 |

0 |

85 5 |

Solar Th. |

719 [222] |

8.1 [223] |

221.2 40 |

20 81 |

11.3[224] |

0 |

NA |

Direct Elec. |

40 [225] |

0 .18 [226] |

1.47 40 |

15 81 |

100 |

0 |

100 |

10.9 kWth Belaria compact IR heat pump 89.

Catalog data divided by 2.89. 2.89 is the ratio between Swiss catalog prices and prices found in the literature. Calculated by dividing the average price of a decentralised NG boiler (489 CHF2015/kWth) in Swiss catalogs 90 by the price for the equivalent technology found in literature (169 CHF2015/kWth, from 5).

6 kWth air-water heat pump 81.

Specific investment cost for a 15.1 kWth absorption heat pump (Vitosorp 200-F) 90

3% of cinv (assumption).

Assumed same technology as for industrial CHP NG (Table 13)

Assumed to be equivalent to a 100 kWe internal combustion engine cogeneration NG system 52,79.

Assuming same impact as decentralised NG CHP.

Efficiency data for a 200 kWe diesel engine 40

System cost (including markup) for a 5 kWe solid-oxide FC system, assuming an annual production of 50000 units 91.

2% of the investment cost 69.

Solid-oxide FC coupled with a NG turbine, values for very optimistic scenario in 2025 87.

Assumed to be equivalent to FC NG.

Assuming same impact as NG and oil decentralised boilers.

6% of cinv, based on ratio between investment and OM cost of boiler of similar size in 78.

504 CHF2015/m\(^2\) for the UltraSol Vertical 1V Hoval system 89. For conversion from €2015/m\(^2\) to €2015/kWth, it is assumed an annual heat capacity factor of 6.5% based on Uccles data.

1.1% of the investment cost, based on ratio investment-to-OM cost in 81.

The calculation of the capacity factor for solar thermal is based on the IRM model 36 with radiation data from the city of Uccles, Belgium.

Resistance heaters with fan assisted air circulation in 78.

In the lack of specific data, same investment-to-OM ratio as for direct electric heating in the industry sector (Table 13).

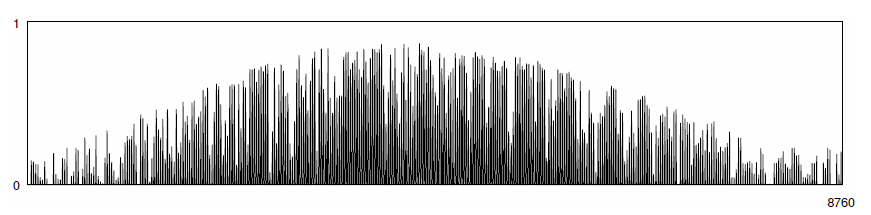

Figure 21 represents the capacity factor (\(c_{p,t}\)) of solar thermal panels. The time series is the direct irradiation in Uccles in 2015, based on measurements of IRM. For all the other heat supply technologies (renewable and non-renewable) \(c_{p,t}\) is equal to the default value of 1.

Fig. 21 Capacity factor of thermal solar panels over the year.

Transport

Passenger mobility

The vehicles available for passenger mobility are regrouped in two categories: public and private. Private accounts for all the cars owned (or rented) by the user, such as a gasoline car, a diesel car… In opposition to private, public mobility accounts for the shared vehicles. It accounts for buses, coaches, trains, trams, metro and trolleys. From the literature, data about mobility is not directly transposable to the model. Data about mobility are usually given per vehicles, such as a vehicle cost or an average occupancy per vehicle. These data are summarised in Table 16.

Vehicle type |

\(Ve h.~Cost\) |

\(Ma intenance\) [241] |

\(Oc cupancy\) |

\(Av. ~distance\) |

\(Av. ~speed\) |

\(li fetime\) [242] |

\(gw p_{ constr}\) |

[k€\(_\ 2015\) /veh.] |

[k€\(_\ 2015\) /veh./y] |

[ pass/ veh.] |

[1000 km/y] |

[ km/h] |

[ years] |

||

Gasoline car |

21 [243] |

1.2 |

1.26 [244] |

18 [245] |

40 |

10 |

17.2 |

Diesel car |

22 [243] |

1.2 |

1.26 [244] |

18 [245] |

40 |

10 |

17.4 |

NG car |

22 [243] |

1.2 |

1.26 [244] |

18 [245] |

40 |

10 |

17.2 |

HEV car |

22 [243] |

1.74 |

1.26 [244] |

18 [245] |

40 |

10 |

26.2 |

PHEV car |

23 [243] |

1.82 |

1.26 [244] |

18 [245] |

40 |

10 |

26.2 |

BEV [246] |

23 [243] |

0.5 |

1.26 [244] |

18 [245] |

40 |

10 |

19.4 |

FC car |

22 [243] |

0.5 |

1.26 [244] |

18 [245] |

40 |

10 |

39.6 |

Tram and metro |

2500 |

50.0 |

200 |

60 |

20 |

30 |

0 [247] |

Diesel bus |

220 |

11.0 |

24 |

39 |

15 |

15 |

0 [247] |

Diesel HEV bus |

300 |

12.0 |

24 |

39 |

15 |

15 |

0 [247] |

NG bus |

220 |

11.0 |

24 |

39 |

15 |

15 |

0 [247] |

FC bus |

375 |

11.3 |

24 |

39 |

15 |

15 |

0 [247] |

Train pub. |

10000 |

200.0 |

80 |

200 |

83 |

40 |

0 [247] |

own calculation. The maintenance cost was assumed proportional to the investment cost and depending the type of powertrain. the average speed of private cars is calculated assuming that it is used 5% of the time (i.e. 1h12). Knowing the annual distance, the value is approximately 40 km/h.

In 2016, the average age of private cars was 8.9 years with a difference between regions 92.

Costs are from mid-range vehicles estimation and projections of 93.

The federal bureau office estimates a decreasing average occupancy for cars down to 1.26 passenger/vehicle in 2030 94).

In 2016, averaged yearly distance for private cars were between 9 500 and 21 100 kms depending on the type of powertrains, but in average around 18 000 kms.

Low range BEV have been implemented. Otherwise the investment cost is more than twice.

No data found.

In Belgium, the car occupancy rate is less than 1.3 passengers per car: 1.3 in 2015 and estimated at 1.26 in 94. The annual distance of a car depends on its type of motorization: from 9 500 km/year for a city gasoline car, to 21 100 km/year for a CNG one. On average, the distance is 18 000 km/year. The average age of a car is 8.9 years in 2016, with a variation between regions: in Brussels it is 10 years. On average, the distance is 18 000 km/year. The average age of a car is 8.9 years in 2016, with a rather strong variation between regions: in Brussels it is 10 years. Finally, a car drives on average a slightly more than one hour a day (1h12). Although private car usage habits may change, we extrapolate these data from today to future years. Certain trends, such as the mutualisation of a car, could lead to an increase in the annual distance travelled by a car. But other trends, such as autonomous cars, could lead to a further decrease in the car occupancy rate, to values below 1. These change may influence in both direction the specific price of a kilometer passenger provided by a car.

For public transportation, the data were collected from various report 95,96,97. These data have been adapted based on discussion with experts in the field. They are reported in Table 16.

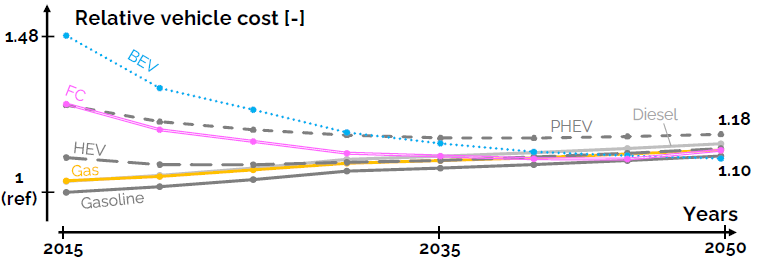

Surprisingly, in 2035, vehicles cost are similar regardless the power-train. Figure 22 shows how the vehicle cost vary over the transition, data from 93. Today, we verify a strong price difference between the different technologies, this difference will diminish with the development of new technologies. The price difference between two technologies will become small as early as 2035 (\(\leq\)10%). In their work, National Research Council93 estimates the cost of promising technologies in 2015 lower than the real market price. This is the case for BEV and FC vehicles, where the price ranges today around 60 k€2015 . These differences can be justified by three facts: these vehicles are usually more luxurious than others; The selling price do not represent the manufacturing cost for prototypes; the study is from 2013 and may have overestimated the production in 2015 and 2020.

Fig. 22 Mid-range vehicle costs evolution during the transition. Reference (1.0 (ref)) is at 19.7 k€2015. Abbreviations: Carbon capture (CC), LFO, methanation (methan.), methanolation (methanol.), Natural Gas (NG), Synthetic Natural Gas (SNG), storage (sto.) and synthetic (syn.).

From data of Table 16, specific parameters for the model are deduced. The specific investment cost (\(c_{inv}\)) is calculated from the vehicle cost, its average speed and occupancy, Eq. (44). The capacity factor (cp) is calculated based on the ratio between yearly distance and average speed, Eq. (45). The vehicle capacity is calculated based on the average occupancy and average speed, Eq. . (46). Table 17 summarises these information for each passenger vehicle.

An additional vehicle is proposed: methanol car. This choice is motivated to offer a zero emission fuels that could be competitve compared to electric or hydrogen vehicles. We assume that methanol is used through a spark-ignition engine in cars, and has similar performances than a gasoline car. This technology is added in the following tables.

Vehicle type |

\(c_ {inv}\) |

\(c_ {maint}\) |

\(g wp_{ constr}\) |

\(c_ p\) |

\(V eh.~capa\) |

[€/km -pass] |

[€/km -pass/h] |

[€/km -pass /h/y] |

[kgCO2 -eq./km -pass/h] |

[%] |

[pass-km /h/veh.] |

Gasoline car |

420 |

24 |

342 |

5.1 |

50 |

Diesel car |

434 |

24 |

346 |

5.1 |

50 |

NG car |

429 |

24 |

342 |

5.1 |

50 |

HEV car |

429 |

34 |

519 |

5.1 |

50 |

PHEV car |

456 |

34 |

519 |

5.1 |

50 |

BEV |

450 |

10 |

385 |

5.1 |

50 |

FC car |

435 |

10 |

786 |

5.1 |

50 |

Methanol car [259] |

420 |

24 |

342 |

5.1 |

50 |

Tram and metro |

625 |

12.5 |

0 [250] |

34.2 |

4000 |

Diesel bus |

611 |

30.6 |

0 [250] |

29.7 |

360 |

Diesel HEV bus |

833 |

33.3 |

0 [250] |

29.7 |

360 |

NG bus |

611 |

30.6 |

0 [250] |

29.7 |

360 |

FC bus |

1042 |

31.3 |

0 [250] |

29.7 |

360 |

Train pub. |

1506 |

54.4 |

0 [250] |

27.5 |

6640 |

No data found

No data were found for methanol cars. Thus, we assume that the technology is similar to a gasoline car (except the fuel).

Table 18 summarises the forecast energy efficiencies for the different vehicles. For public vehicles in 2035, the energy efficiencies are calculated with a linear interpolation between the 2010 and 2050 values presented in Table 6 in Codina Gironès et al 98. For private vehicles, Estimation for energy consumption for Belgium cars in 2030 are used 94.

Vehicle type |

Fuel |

Electricity |

f\(_\textbf{min,%}\) |

f\(_\textbf{max,%}\) |

[Wh/km-pass] |

[Wh/km-pass] |

[Wh/km-pass] |

[%] |

|

Gasoline car |

497 [251] |

0 |

0 |

1 |

Diesel car |

435 [251] |

0 |

0 |

1 |

NG car |

543 [251] |

0 |

0 |

1 |

HEV [252] |

336 [251] |

0 |

0 |

1 |

PHEV [253] |

138 [251] |

109 [251] |

0 |

1 |

BEV |

0 |

173 [251] |

0 |

1 |

FC car |

264 [254] |

0 |

0 |

1 |

Methanol car |

497 [251] |

0 |

0 |

1 |

Tram & Trolley |

0 |

63 [255] |

0 |

0.17 [256] |

Diesel bus |

265 |

0 |

0 |

1 |

Diesel HEV bus |

198 |

0 |

0 |

1 |

NG bus |

268 |

0 |

0 |

1 |

FC bus |

225 |

0 |

0 |

1 |

Train pub. |

0 |

65 [255] |

0 |

0.60 [256] |

calculation based on vehicle consumption in 2030 94 and occupancy of 2030 94. According to 98, gas car are assumed to consume 25% more than diesel cars.

Using gasoline as only fuel.

It is assumed that electricity is used to cover 40% of the total distance and petrol to cover the remaining 60%.

In FC car are estimated to consume 52.6% more than BEV in 2035, see Table 2.12 in 93

Based on real data for the French case in 2004, from 99. An increase of efficiency of 25% was assume.

In 2015, the public mobility was shared as follow: trains (37.0%), trams/metros (8.7%) and buses (54.3%) 32. In 2035, we assume an upper limit twice greater than real data in 2015. Except for train were a maximum of 60% is imposed.

The size of the BEV batteries is assumed to be the one from a Nissan Leaf (ZE0) (24 kWh [257]). The size of the PHEV batteries is assumed to be the one from Prius III Plug-in Hybrid (4.4 kWh [258]). The performances of BEV and PHEV batteries are assimilated to a Li-ion battery as presented in Table 30. The state of charge of the electric vehicles (\(soc_{ev}\)) is constrained to 60% minimum at 7 am every days.

Freight mobility

The technologies available for freight transport are trains, trucks and boats. Similarly to previous section, the information for the freight is given per vehicles. These data are summarised in Table 19.

Vehicle type |

\(Ve h.~Cost\) |

\(Ma intenance\) [263] |

\(To nnage\) |

\(Av. ~distance\) |

\(Av. ~speed\) [263] |

\(li fetime\) |

[k€\(_ {2015}\) /veh.] |

[k€\(_ {2015}\) /veh./y] |

[ pass/ veh.] |

[1000 km/y] |

[ km/h] |

||

Train freight [263] |

4020 |

80.4 |

550 |

210 |

70 |

40 |

Boat Diesel [263] |

2750 |

137.5 |

1200 |

30 |

30 |

40 |

Boat NG [263] |

2750 |

137.5 |

1200 |

30 |

30 |

40 |

Boat Methanol |

2750 |

137.5 |

1200 |

30 |

30 |

40 |

Truck Diesel |

167 |

8.4 |

10 |

36.5 [264] |

45 |

15 |

Truck FC |

181 |

5.4 |

10 |

36.5 |

45 |

15 |

Truck Elec. |

347 |

10.4 |

10 |

36.5 |

45 |

15 |

Truck NG |

167 |

8.4 |

10 |

36.5 |

45 |

15 |

Own calculation

In 2016, the average distance was between 16 974 up to 63 305 km per year depending on the truck category. Based on our own calculation, we found an average of 36 500 km per year.

Trucks have similar cost except for electric trucks. This last have a battery that supplies the same amount of kilometers than other technologies. As a consequence, half of the truck cost is related to the battery pack.

From Table 19, specific parameters for the model are deduced. Except for the technology construction specific GHG emissions (\(gwp_{constr}\)) where no data was found. The specific investment cost (cinv) is calculated from the vehicle cost, its average speed and occupancy, Eq. (47). The capacity factor (cp) is calculated based on the ratio between yearly distance and average speed, Eq. (48). The vehicle capacity is calculated based on the average occupancy and average speed, Eq. Eq. (49). Table 20 summarises these information for each freight vehicle.

Similarly to the methanol car, additional power trains have been added in order to open the competition between fuels and electric vehicles (including fuel cells electri vehicles). Methanol could be use with performances similar to the use of methane. Based on this approach, two technologies have been added: methanol boats and methanol trucks.

Vehicle type |

\(c_ {inv}\) |

\(c_ {maint}\) |

\(c_ p\) |

\(V eh.~capa\) |

[€/km-t/h] |

[€/km-t/h/y] |

[%] |

[t-km/h /veh.] |

|

Train freight |

104 |

2.1 |

34.2 |

38500 |

Boat Diesel |

76 |

3.8 |

11.4 |

36000 |

Boat NG |

76 |

3.8 |

11.4 |

36000 |

Boat Methnanol |

76 |

3.8 |

11.4 |

36000 |

Truck Diesel |

371 |

18.6 |

9.3 |

450 |

Truck FC |

402 |

12.1 |

9.3 |

450 |

Truck Elec. |

771 |

23.1 |

9.3 |

450 |

Truck NG |

371 |

18.6 |

9.3 |

450 |

Truck Methanol |

371 |

18.6 |

9.3 |

450 |

Trains and boats benefit on a very high tonnage capacity, and thus drastically reduce their specific investment cost down to 4-5 times lower than trucks. Table 20 summarises the forecast energy efficiencies for the different vehicles in 2035. Except for the technology construction specific GHG emissions (\(gwp_{constr}\)) where no data was found.

Vehicle type |

Fuel |

Electricity |

[Wh/km-t] |

[Wh/km-t] |

|

Train freight |

0 |

68 |

Boat Diesel |

107 |

0 |

Boat NG |

123 |

0 |

Boat Diesel |

107 |

0 |

Truck Diesel |

513 |

0 |

Truck FC |

440 |

0 |

Truck Elec. |

0 |

249 [265] |

Truck NG [266] |

590 |

0 |

Truck Diesel |

513 |

0 |

Energy intensity calculated based on the diesel one, and corrected with an electric to diesel powertrain ratio from 100.

The efficiency is corrected with the ratio between NG bus and diesel bus.

Trains are considered to be only electric. Their efficiency in 2035 is 0.068 kWh/tkm 98. The efficiency for freight transport by diesel truck is 0.51 kWh/tkm based on the weighted average of the efficiencies for the vehicle mix in 98. For NG and H2 trucks, no exact data were found. Hence, we assume that the efficiency ratio between NG coaches and diesel coaches can be used for freight (same for H2 trucks). As a consequence, the efficiency of NG and H2 trucks are 0.59 and 0.44 kWh/tkm. Boats are considered to be diesel or gas powered. In 2015, the energy intensity ratio between diesel boats and diesel trucks were \(\approx\)20% [267]. By assuming a similar ratio in 2035, we find an efficiency of 0.107 kWh/tkm and 0.123 kWh/tkm for diesel and gas boats, respectively.

Non-energy demand

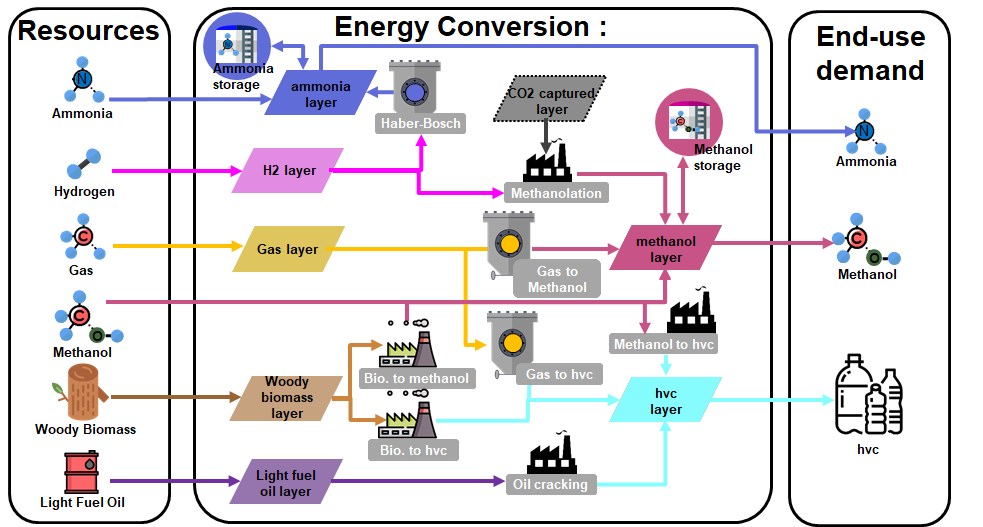

Non-energy demand plays a major role in the primary energy consumption in Belgium (20% in 2015, 43). Rixhon et al.101 investigates the importance of non-energy demand worlwide and its projection based on the IEA reports (102). Three main feedstocks have been chosen : ammonia, methanol and high-value chemicals (HVCs). This latter encompass different molecules, mainly hydrocarbons chains. Figure 23 illustrates the different conversion pathway to produce the different non-energy demand feedstocks.

Fig. 23 Illustration of the technologies that produce non-energy feedstocks. For clarity, only the most relevant flows are drawn (Figure Figure 1 includes all the flows). Ammonia and methanol can be used in other sectors.

The Non-energy end-use demand is usuallty expressed in TWh/y without specifying the split among the feedstocks, such as the forecast used which are proposed by the European commission 27. In Rixhon et al.101, they analysed the split among the three proposed feedstocks. In 2015, 77.9% of the NED accounted was for HVC, 19.2% for ammonia and only 2.9% for Methanol. Worlwide, the IEA forecast a similar growth for the different feedstocks (see Figure 4.5 of 102). Thus, we assume a constant share between the three feedstocks.

Similarly to electricity, two of the three feedstocks can be used for other end-use demands. As an example, ammonia can be used for electricity production or methanol for mobility. Table 22 summarises the technology that produces HVC; Table 23 summarises the technology that produces methanol; and for ammonia, only the Haber-Bosch process is proposed in Table 24

\(c_ {inv}\) |

\(c_ {maint}\) |

\(life time\) |

\(c_p\) |

\(\eta_ {fuel}\) |

\(\eta_ {e}\) |

\(\eta_ {th,ht}\) |

\(CO_ {2,direct}\) [359] |

|

[€\(_ {2015}\)/kW\(_ {fuel}\)] |

[€\(_ {2015}\)/kW\(_ {fuel}\)/y] |

[y] |

[%] |

[MWh/MWh\(_ {HVC}\)] |

[MWh/MWh\(_ {HVC}\)] |

[MWh/MWh\(_ {HVC}\)] |

[tCO2 /MWhe] |

|

395 |

2.1 |

15 |

100 |

1.82 |

0.021 |

0.017 |

0.213 |

|

Gas to HVC 105 |

798 |

20 |

25 |

100 |

2.79 |

0.47 |

0 |

0.299 |

Biomass to HVC 106 |

1743 |

52 |

20 |

100 |

2.38 |

0.029 |

0.052 |

0.669 |

697 |

63 |

20 |

100 |

1.24 |

0 |

0.045 |

0.304 |

\(c_ {inv}\) |

\(c_ {maint}\) |

\(life time\) |

\(c_p\) |

\(\eta_ {fuel}\) |

\(\eta_ {e}\) |

\(\eta_ {th}\) |

\(CO_ {2,direct}\) [359] |

|

[€\(_ {2015}\)/kW\(_ {fuel}\)] |

[€\(_ {2015}\)/kW\(_ {fuel}\)/y] |

[y] |

[%] |

[%] |

[%] |

[%] |

[tCO2 /MWhe] |

|

Biomass to methanol 109 |

2520 |

38.5 |

20 |

85 |

62 |

2 |

22 |

0.236 |

Syn. methanolation [361] |

1680 |

84 |

20 |

67 |

0 |

0 |

26.1 |

-0.248 |

958.6 |

47.9 |

20 |

1 |

65.4 |

0 |

0 |

0.306 |

\(c_ {inv}\) |

\(c_ {maint}\) |

\(life time\) |

\(c_p\) |

\(\eta_ {fuel}\) |

\(\eta_ {e}\) |

\(\eta_ {th}\) |

\(CO_ {2,direct}\) [359] |

|

[€\(_ {2015}\)/kW\(_ {fuel}\)] |

[€\(_ {2015}\)/kW\(_ {fuel}\)/y] |

[y] |

[%] |

[%] |

[%] |

[%] |

[tCO2 /MWhe] |

|

Haber bosch [364] |

847 |

16.6 |

20 |

85 |

79.8 (NH3) |

0 |

10.7 |

0 |

To produce 1 unit of ammonia, the system uses 1.13 units of H2 and 0.123 of electricity.

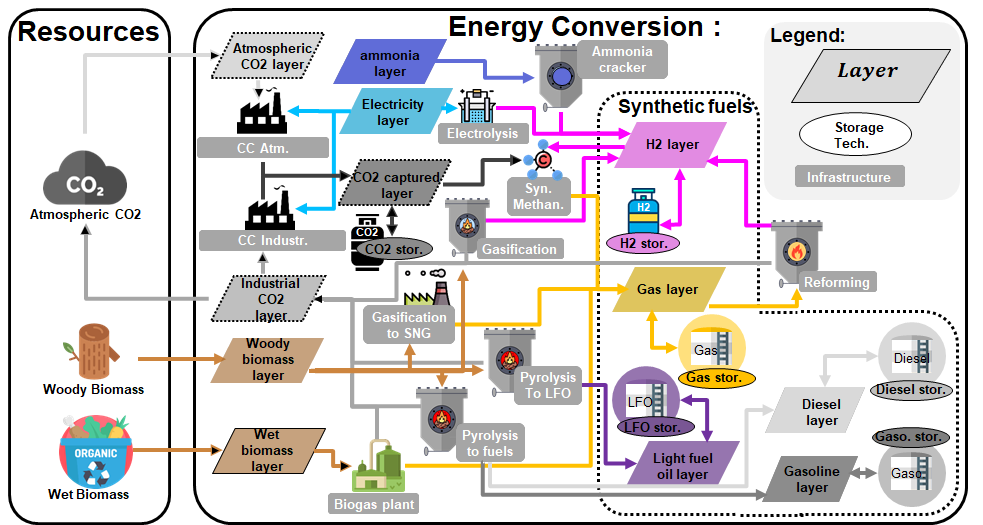

Synthetic fuels production

Synthetic fuels are expected to play a key role to phase out fossil fuels 111. Figure 24 represents the technology related to synthetic fuels, including the CO2 layers. Synthetic fuels can be imported (Bio-ethanol, Bio-Diesel, H2 or SNG) or produced by converting biomass and/or electricity. The wet biomass - usually organic waste - can be converted through the biogas plant technology to SNG. This technology combines anaerobic digestion and cleaning processes. Woody biomass can be used to produce H2 through gasification, or different oils through pyrolysis or SNG through gasification to SNG. The different oil account for LFO, Gasoline or Diesel. The other processes to produce synthetic fuels are based on the water electrolysis, where the electrolysers convert electricity to H2. Then, the H2 can be combined with CO2 and upgraded to SNG through the methanation technology. In this latter, the process requires CO2. It can either be captured from large scale emitters, such as the industries and centralised heat technologies; or directly captured from the air but at a higher energetic and financial cost.

Fig. 24 Illustration of the technologies and processes to produce synthetic fuels. For clarity, only the most relevant flows are drawn (Figure Figure 1 includes all the flows). This Figure also illustrates how Carbon capture is implemented in the model. The CO:sub:2 emissions of large scale technologies can be either released at the atmosphere or captured by the Carbon Capture Industrial technolgy. Otherwise, CO:sub:2 can be captured from the atmosphere at a greater cost.

Hydrogen production

Three technologies are considered for hydrogen production: electrolysis, NG reforming and biomass gasification. The last two options can include CCS systems for limiting the CO\(_2\) emissions. They are Different technologies for electrolysis, in their work the Danish Energy Agency109 review the PEM-EC, A-EC and SO-EC. Table 25 summarises the key characteristics for these technologies in year 2035.

\(c_ {inv}\) |

\(c_ {maint}\) |

\(life time\) |

\(\eta_ e\) |

\(\eta_ {h.t.}\) |

\(\eta_ {H2}\) |

\(\eta_ {l.t.}\) |

|

[€\(_ {2015}\)/kW\(_ {H2}\)] |

[€\(_ {2015}\)/kW\(_ {H2}\)/y] |

[y] |

[%] |

[%] |

[%] |

[%] |

|

PEM-EC |

870 |

40 |

15 |

-100 |

63 |

12 |

|

A-EC |

806 |

43 |

25 |

-100 |

67 |

11 |

|

SO-EC |

696 |

21 |

23 |

-85 |

-15 |

79 |

1.5 |

The different electrolyser cell technologies have a similar cost, however each technologies differ by their lifetime and electricity to hydrogen efficiencies. PEM-EC has the shortest lifetime and the lowest electricity to hydrogen efficiency, thus this technology will never be implemented in the model [335]. Electrolysers will be needed during excesses of electricity production, where heat demand is usually low. Thus, they aim at maximising the production of hydrogen rather than low temperature heat. For this reason, SO-EC appear as the most promising technology SO-EC appears as the most promising technology and will be implemented in the model. Thus, in this work, the term Electrolysis refers to SO-EC. Table 26 contains the data for the hydrogen production technologies.

\(c_ {inv}\) |

\(c_ {maint}\) |

\(life time\) |

\(c_p\) |

\(\eta_ {H2}\) |

\(CO_ {2,direct}\) [346] |

|

[€\({ _2015}\)/kW\(_ {H2}\)] |

[€\({ _2015}\)/kW\(_ {H2}\)/y] |

[y] |

[%] |

[%] |

[tCO2 /MWhe] |

|

696 |

21 |

23 |

90 [348] |

79 [351] |

0 |

|

681 |

64.4 |

25 |

86 |

73 |

0.273 |

|

2525 |

196 |

25 |

86 |

43 |

0.902 |

|

Ammonia cracking [352] |

1365 |

38 |

25 |

85 |

59.1 |

0 |

Direct emissions due to combustion. Expressed in ton CO2 per MWh of fuel produced. Emissions computed based on resource used and specific emissions given in Table 8.

It uses electricity and high temperature heat as feedstock, see Table 25.

Own assumptions.

It uses gas as feedstock, such as NG.

It uses wood biomass as feedstock.

To produce one unit of H2, the system requires 1.076 units of electricity and 0.19 units of heat high temperature. We assume that, on top of the unit of H2 produced, an extra 0.019 units of low temperature heat can be recovered for district heating.

Cracking ammonia doesn’t exist at industrial scale. Indeed, ammonia is produced from hydrogen throuth the Haber-Bosch process. Thus, we didn’t found reliable data and did our own calculation based on Haber bosch process and methane cracking.

Synthetic methane and oils production

Three technology options are considered for the conversion of biomass to synthetic fuels: pyrolysis, gasification and biomethanation. The main product of the pyrolysis process is bio-oil. Two different pyrolysis process are thus proposed. One producing light fuel oil, and another one producing a blend of gasoline and diesel. The main product of the gasification and biomethanation processes are SNG, which is considered equivalent to gas. Data for the technologies are reported in Table 27 (from 5). The biomethanation process is based on anaerobic digestion followed by a cleaning process in order to have gas that can be reinjected in the gas grid 109,113. In the table, efficiencies are calculated with respect to the wood in input (50% humidity, on a wet basis LHV) and ‘fuel’ stands for the main synthetic fuel in output. Finally, a last technology can produce methane from hydrogen and sequestrated CO:sub:2.

\(c_ {inv}\) |

\(c_ {maint}\) |

\(life time\) |

\(c_p\) |

\(\eta_ {fuel}\) |

\(\eta_ {e}\) |

\(\eta_ {th}\) |

\(CO_ {2,direct}\) [359] |

|

[€\(_ {2015}\)/kW\(_ {fuel}\)] |

[€\(_ {2015}\)/kW\(_ {fuel}\)/y] |

[y] |

[%] |

[%] |

[%] |

[%] |

[tCO2 /MWhe] |

|

Pyrolysis to LFO [363] |

1344 |

67.2 |

25 |

85 |

66.6 |

1.58 |

0.586 |

|

Pyrolysis to fuels [363] |

1365 |

38 |

25 |

85 |

57.4 |

1.58 |

0.586 |

|

Gasification |

2525 |

178 |

25 |

85 |

65 |

0 |

22 |

0.260 |

Biomethanation [360] |

986 |

88 |

25 |

85 |

29.9 |

0 |

0 |

0.722 |

Hydrolisis methanation 114 |

1592 |

112 |

15 |

100 |

42.3 |

0 |

4 |

0.306 |

Syn. methanation 115 |

280 |

0.21 |

30 |

86 |

83.3 |

0 |

0 |

-0.198 |

Direct emissions due to combustion. Expressed in ton CO2 per MWh of fuel produced. Emissions computed based on resource used and produced and specific emissions given in Table 8.

Data from 116 to produce 1 MWh of methanol, the process requires 1.355 MWh of hydrogen and also 0.04 MWh of electricity, 0.107 MWh of heating and 0.210 units of cooling. The process is simplified to 1.5 MWh of hydrogen needed to produce 1 MWh of methanol.

This technology might be removed. Indeed, in this version of the model, synthetic liquid fuels are gathered together. However, they should be split in methanol, ethanol, bio-diesel… As a consequence, producing methanol from methane is cheaper than importing diesel. However in this version, methanol can be directly used as diesel \(\rightarrow\) a competitor.

A distinction is made between pyrolysis to LFO and other fuels. The first can produce oil for heating or non-energy demand. The second produce a blend of diesel and gasoline (18% of gasoline and 39.4% of diesel).

Carbon capture and storage

As represented in Figure 24, two technologies are proposed to capture the CO2, one from atmosphere (CC atmospheric) and the other from exhaust gases of conversions processes (CC industry), such as after a coal power plant. Indeed, resources emit direct CO2 from combustion and CC industry can concentrate CO2 contained in the exhaust gas and inject it in CO2 captured layer. The same process can be performed at a higher energetical cost with CO2 from the atmosphere. No restriction on the available limit of CO2 from the atmosphere is considered. Data are summarised in Table 28.

We suppose that CC industry has similar characteristics than a sequestration unit on a coal power plant as proposed in 35. Based on our own calculation, we evaluated the economical and technical data. We assumed that the energy drop of the power plant represents the amount of energy that the sequestration unit consumes. We assume that this energy must be supplied by electricity.

For CC atmospheric, Keith et al.117 proposed an installation where 1 ton of CO2 is captured from the atmosphere with 1.3 kWh of natural gas and electricity. We assume that it can be done with 1.3 kWh of electricity. The thermodynamical limit is estimated to be around 0.2 kWh of energy to sequestrate this amount 118.

\(c_ {inv}\) |

\(c_ {maint}\) |

\(life time\) |

\(E_e\) |

\(\eta_ {CO_2}\) |

\(f_ {min,\%}\) |

\(f_ {max,\%}\) |

|

[€\(_ {2015}\)/kW\(_ {fuel}\)] |

[€\(_ {2015}\)/kW\(_ {fuel}\)/y] |

[y] |

[kWh:sub`e`/ tCO2] |

[%] |

[%] |

[%] |

|

CC Ind. |

2580 |

64.8 |

40 |

0.233 |

90 [367] |

0 |

100 |

CC Atm. |

5160 [368] |

129.6 |

40 |

1.3 |

100 |

0 |

100 |

We consider that 10% of the CO2 cannot be collected.

Based on the economical data given in 117 and own calculation.

No relevant data were found for the capacity factor (\(\textbf{c}_\textbf{p}\)) and the GWP associated to the unit construction.

Storage

Tables 29 and 30 detail the data for the storage technologies. Table 29 summarises the investment cost, GWP, lifetime and potential integration of the different technologies. Table 30 summarises the technical performances of each technology.

\(c_ {inv}\) |

\(c_ {maint}\) |

\(gw p_{con str}\) |

\(li fetime\) |

|

[\(\ €_{2015}\) /kWh] |

[\(\ €_{2015}\) /kWh/y] |

[kgCO2 -eq./kWh] |

[y] |

|

Li-on batt. |

302 [294] |

0.62 [294] |

61.3 [295] |

15 [296] |

PHS |

58.8 |

0 [297] |

8.33 [298] |

50 [299] |

TS dec. |

19.0 [300] |

0.13 [300] |

0 [297] |

25 [300] |

TS seas. cen. |

0.54 [301] |

0.003 [301] |

0 [297] |

25 [301] |

TS daily cen. |

3 [301] |

0.0086 [301] |

0 [297] |

40 [300] |

TS high temp. |

28 |

0.28 |

0 [297] |

25 |

Gas |

0.051 [302] |

0.0013 [302] |

0 [297] |

30 [302] |

H2 |

6.19 [303] |

0.03 [303] |

0 [297] |

20 [303] |

Diesel [304] |

6.35e-3 |

3.97e-4 |

0 [297] |

20 |

Gasoline [304] |

6.35e-3 |

3.97e-4 |

0 [297] |

20 |

LFO [304] |

6.35e-3 |

3.97e-4 |

0 [297] |

20 |

Ammonia [304] |

6.35e-3 |

3.97e-4 |

0 [297] |

20 |

Methanol [304] |

6.35e-3 |

3.97e-4 |

0 [297] |

20 |

CO2 [305] |

49.5 [306] |

0.495 |

0 [297] |

20 |

We assume a Lithium-ion NMC battery at a utility-scale in 2030 119 with average use of 100 cycles/year.

Data from Table 4 of 44.

Neglected.

Own calculation based on Hydro Dams emissions from previous work 2,5.

Data verified in Table B1 of 120.

Adapted from Table 5.2 of 121.

The technologies used are pit thermal energy storage technology and Large-scale hot water tanks for seasonal and daily DHN storage, respectively. Data was taken for year 2030 119.

Data from the Torup Lille project 119. The lifetime is assumed similar to a cavern for hydrogen storage.

Based on tank storage from the JRC project:cite:simoes2013jrc. The cost is assumed as the average of 2020 and 2050 costs.

In this implementation, the power of fuel imported can be constrained to be constant among the year. Thus, a storage is created for the fuel, even if the storage cost is negligeable (see Eq. (41)). Data were obtained by our own calculation.

Based on liquid CO2 tank storage. Data from a datasheet of Ever grow gas company https://www.evergrowgas.com/. Lifetime and maintenance cost based on own calculation.

Units: cinv [€2015/tCO2], cop [€2015/tCO2/y]

The PHS in Belgium can be resumed to the Coo-Trois-Ponts hydroelectric power station. The characteristics of the station in 2015 are the following: installed capacity turbine (1164MW), pumping (1035MW), overall efficiency of 75%, all reservoirs capacity (5000 MWh). We assume that the energy losses is shared equally between the pumping and turbining, resulting by a charge/discharge efficiencies of 86.6%. The energy to power ratio are 4h50 and 4h18 for charge and discharge, respectively 122. A project started to increase the height of the reservoirs and thus increase the capacity by 425 MWh. In addition, the power capacity will be increase by 80MW. The overall project cost is estimated to 50M€ and includes also renovation of other parts [307]. We arbitrary assume that 50% is dedicated for the height increase. It results in an investment cost of 58.8€2015 per kWh of new capacity. The overall potential of the PHS could be extended by a third reservoir with an extra capacity of around 1.2 GWh. Hence, we assume that the upper limit of PHS capacity is 6.5 GWh. No upper bound were constrained for other storage technologies.

Estimation for the gas storage is based on an existing facility using salt caverns as reservoirs: Lille Torup in Danemark 119. The project cost is estimated to 254M€2015 for an energy capacity of 4965 GWh. The yearly operating cost is estimated to 6.5 M€2015. Part of it is for electricity and gas self consumption. We assume that the electricity is used for charging the system (compressing the gas) and the gas is used for heating up the gas during the discharge. These quantities slightly impact the charge and discharge efficiency of the system. The charge and discharge power are 2200 and 6600 [MW] respectively. As the technology is mature, we assume that the cost of the technology in 2035 will be similar to Lille Torup project.

\(\eta_ {sto,in}\) |

\(\eta_ {sto,out}\) |

\(t_ {sto,in}\) |

\(t_ {sto,out}\) |

\(%_ {sto_{loss}}\) |

\(%_ {sto_{avail}}\) |

|

[-] |

[-] |

[h] |

[h] |

[s\(^ {-1}\)] |

[-] |

|

Li-on batt. |

0.95 [326] |

0.95 [326] |

4 [326] |

4 [326] |

1 |

|

BEV batt. |

0.95 [326] |

0.95 [326] |

4 [328] |

10 [328] |

0.2 [328] |

|

PHEV batt. |

0.95 [326] |

0.95 [326] |

4 [328] |

10 [328] |

0.2 [328] |

|

PHS |

0.866 |

0.866 |

4.30 |

4.83 |

0 [329] |

1 |

TS dec. |

1 [329] |

1 [329] |

4 [328] |

4 [328] |

82e-4 [330] |

1 |

TS seas. cen. |

1 [331] |

1 [331] |

150 [331] |

150 [331] |

6.06e-5 [331] |

1 |

TS daily cen. |

1 [331] |

1 [331] |

60.3 [331] |

60.3 [331] |

8.33e-3 [331] |

1 |

TS high temp. |

1 [331] |

1 [331] |

2 |

2 |

3.55e-4 [331] |

1 |

NG |

0.99 [332] |

0.995 [332] |

2256 [332] |

752 [332] |

0 |

1 |

H2 |

0.90 [333] |

0.98 [333] |

4 [333] |

4 [333] |

0 |

1 |

Diesel [334] |

1 |

1 |

168 |

168 |

0 |

1 |

Gasoline [334] |

1 |

1 |

168 |

168 |

0 |

1 |

LFO [334] |

1 |

1 |

168 |

168 |

0 |

1 |

Ammonia [334] |

1 |

1 |

168 |

168 |

0 |

1 |

Methanol [334] |

1 |

1 |

168 |

168 |

0 |

1 |

CO2 |

1 |

1 |

1 |

1 |

0 |

1 |

Data verified in Table B1 of 120.

Data from Table 4 of 44.

Own calculation.

Neglected.

Adapted from Table 5.2 of 121

Based on the Pit thermal energy storage technology in 2030 for seasonal and Large-scale hot water tanks for DHN daily storage. Data from 119.

Data from the Torup Lille project:cite:DanishEnergyAgency2018. Efficiencies are based on our own calculation based on electricity and gas consumed by the installation over a year.

Sadaghiani and Mehrpooya123 an efficiency of 88.6% in an ideal configuration for liquid hydrogen liquefaction. This high efficiency is used and we arbitrary impose that the charge efficiency is 90% and the discharge 98%. The tank design by JRC 37 has a charge/discharge energy to power ratio of 4 hours.

We assume a perfect storage with 1 week of charge/discharge time.

Others

Electricity grid